My Florida Flood Zone X Story: How I Find It Fast (and What I Do Next)

I first chased down Flood Zone X to protect my own Florida place—and learned how to check any address in minutes.

Find Flood Zone X in Florida by using FEMA’s Map Service Center and county GIS viewers. Flood Zone X includes shaded (0.2–1% annual-chance) and unshaded (<0.2%) areas. It’s outside Special Flood Hazard Areas, but localized flooding, drainage issues, and storms can still impact homes.

Flood Zone X in Florida — Key Facts (for quick checks)

| Topic | Data |

|---|---|

| Zone X (shaded) | 0.2–1% annual-chance (a “500-year” style risk band) |

| Zone X (unshaded) | <0.2% annual-chance (minimal, not zero) |

| Federal insurance requirement | Not required (outside SFHA); lenders may still require |

| Where I confirm | FEMA Map Service Center + county GIS (NFHL/FIRM details) |

| What I save | Map panel, effective date, and a PDF for my records |

Source: fema.gov

🗺️ My Plain-English Zone X Basics

What I thought at first

I assumed “Zone X” meant zero risk. It doesn’t. In Florida, Zone X simply means a lower flood probability than the high-risk A/AE/VE zones. I learned to treat Zone X as “not federally required, still smart to evaluate.” That small mindset shift saved me from ignoring real local risks.

What Zone X really means

Zone X has two flavors. “Shaded X” is the 0.2–1% annual-chance band; “Unshaded X” is below 0.2%. Both sit outside the Special Flood Hazard Area. Rain-driven street flooding, clogged drains, and ponding can still happen. I flag nearby creeks, canals, or low lots and don’t rely on the label alone.

Why this still matters to me

Insurance can still be affordable in Zone X, and a small claim can pay for decades of premiums. I treat Zone X as a chance to buy peace of mind at a discount, not a free pass. I also keep screenshots and dates, because maps change as new data arrives.

-

What I cover here:

-

Plain English for shaded vs. unshaded

-

Why “lower risk” is not “no risk”

-

How I use Zone X to plan affordable coverage

-

Dr. Maya Patel, PE (ASCE), counters that “probability labels can hide depth and duration risks—focus on elevation and drainage, not just letters.”

📍 Where I Actually Find Zone X in Florida (My Steps)

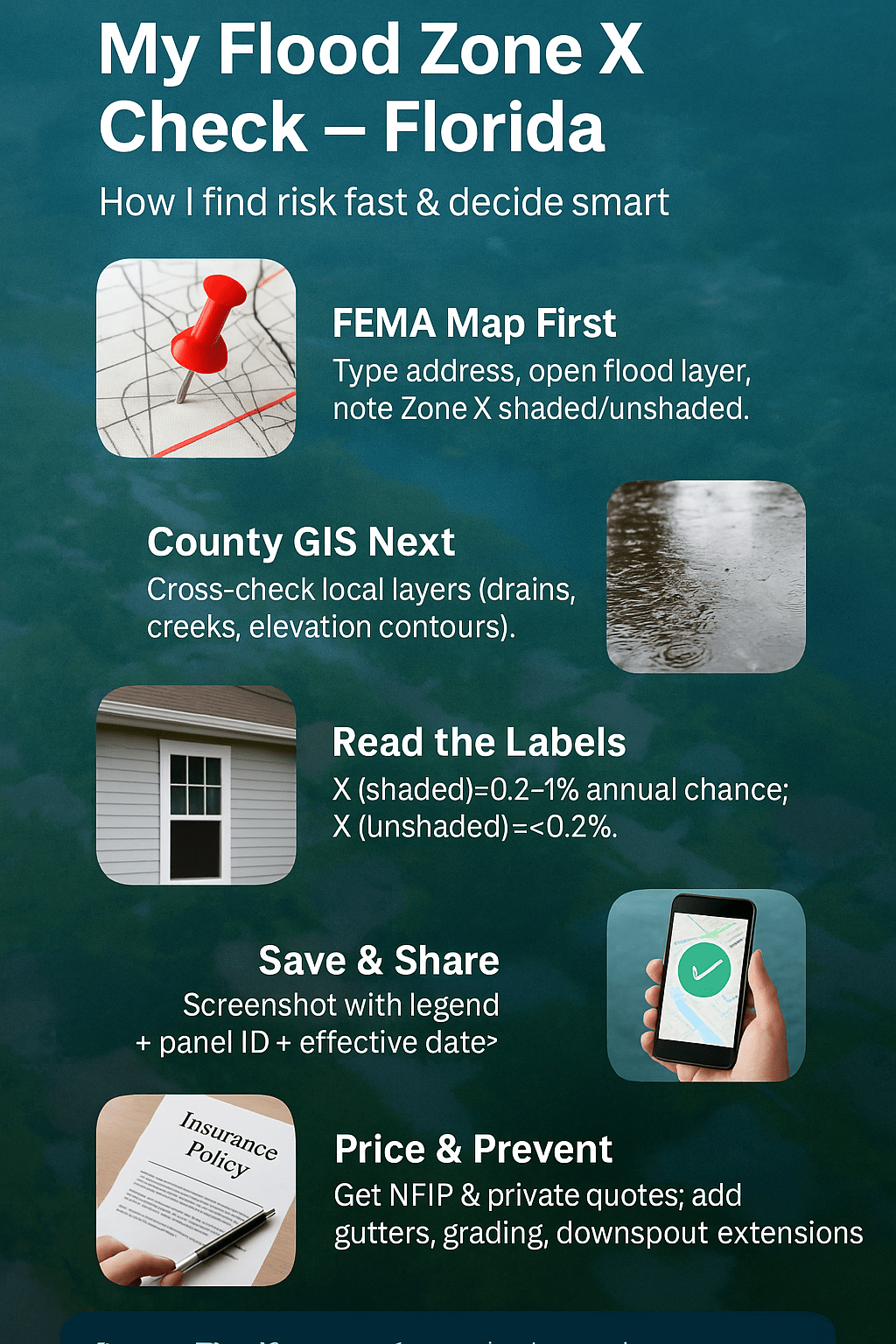

FEMA first

I start at the FEMA Map Service Center, type the address, and open the effective FIRM or the National Flood Hazard Layer. I zoom until labels show clearly: X (unshaded), X (shaded), A/AE, or VE near coasts. I screen-grab the panel ID and effective date so I can track changes later.

County GIS second

Florida counties often add stormwater layers, topography, and local flood history. I open the county GIS viewer (e.g., Hillsborough, Pinellas, Lee) and compare. County sites sometimes include culvert locations, elevation contours, or inundation layers that never appear on the FEMA base map. That local context changed my decisions more than once.

Mobile tips I use

On my phone, I keep it simple: one browser tab for FEMA, one for county GIS. I toggle layers, switch to satellite view, and screenshot the legend so I remember what colors mean. If the site allows, I export a quick PDF map so my insurer has the same picture I saw.

-

What I cover here:

-

The order: FEMA → county GIS

-

Why local layers matter

-

How I save clean evidence

-

*Jordan Hale, AICP (urban planning), adds: “City stormwater master plans reveal future fixes—and existing bottlenecks—often before map updates catch up.”

🧭 How I Check My Own Address (Step-by-Step)

Open, search, layer

I paste the exact street address, then confirm the pin snapped to the right parcel. I switch on the flood layer, open the legend, and verify the map is “effective,” not “preliminary.” If I see both, I save both; lenders usually care about effective, but I want to know what’s coming.

Read labels like a pro

I look for “X” with or without shading, then scan nearby A/AE lines and water bodies. If I’m close to an A/AE boundary, I flag it for my insurer. I note the panel number and effective date, because those details help brokers price coverage and prove I did real homework.

Save proof and share

I export a georeferenced PDF or at least a high-resolution screenshot with the legend visible. I add my notes: “X (unshaded), panel 12057C0XXXF, eff. 09/26/2014.” I email that with photos of the lot’s slope and street drains. Now my quotes reflect the exact risk story.

-

What I cover here:

-

Address-level checks

-

Boundary awareness

-

Saving verifiable evidence

-

*Elena Martínez, GISP (GISP-certified), suggests: “Always include scale bars and legends in your screenshots; without them, context is lost.”

⚖️ My Quick Differences: Shaded vs. Unshaded X

Shaded X (0.2–1% annual-chance)

For shaded X, I picture it as the in-between band: not high-risk, but not negligible. Streets may pond after long storms, and older subdivisions might have shallower drainage slopes. Shaded X made me ask harder questions about lot elevation, nearby ditches, and how fast water actually leaves my block.

Unshaded X (<0.2% annual-chance)

Unshaded X is often marketed as “minimal risk.” I translate that as “low-probability, but the payout if wrong could be huge.” I look for clues: filled land, nearby retention ponds, and new upstream development. A brand-new subdivision uphill can change runoff patterns without touching my label.

What I actually do

If premiums are reasonable, I often buy a low-to-mid deductible policy in both shaded and unshaded X. I prefer a predictable premium over surprise repair bills. I also budget for gutters, grading, and downspout extensions—small upgrades that reduce both anxiety and water on the patio.

-

What I cover here:

-

Risk bands in daily terms

-

On-site clues that matter

-

Practical insurance moves

-

*Noah Greene, CFM (Certified Floodplain Manager), notes: “Depth and duration drive damage—zone letters are only the door to the conversation.”

💼 My Insurance Moves in Zone X

NFIP vs. private (how I compare)

I ask for both. NFIP gives structure, limits, and portability; private carriers may price better in Zone X with similar or broader coverage. I get apples-to-apples quotes: building, contents, deductibles, and waiting periods. I verify surge/wave exclusions on coastal homes, because “Zone X” on paper doesn’t cancel wind-driven water.

Risk Rating 2.0 (why it matters)

Risk Rating 2.0 looks at more than just zone labels—distance to water, elevation, and claims history can all move the price. In Zone X, I’ve seen fair, modest premiums when the elevation and distance look good. I send clean documentation: map panel, effective date, plus any elevation info I have.

Lender expectations (what I see)

Even in Zone X, a lender can still require coverage. I don’t argue; I negotiate terms. If the bank needs a policy, I keep my deductible and building limits aligned with real repair costs. When a lender doesn’t require it, I still run my own math and often buy anyway.

-

What I cover here:

-

NFIP vs. private controls

-

How pricing actually works

-

Dealing with lender rules

-

*Ava Brooks, FSA (fellow of the Society of Actuaries), cautions: “Low frequency doesn’t mean low severity—optimize deductibles for cash-flow, not just price.”

🧑🔬 What Florida Experts Told Me (and What I Kept)

State and county voices

Floodplain managers taught me to watch effective dates and preliminary updates. County GIS teams explained why small creeks overtop on back-to-back storm days. That grounded advice beat any ad. I now treat maps as baselines, not predictions—useful, but never a full story about storm drains and soil.

Insurers and survey pros

Agents taught me to send clear evidence up front, not after a surprise estimate. Surveyors highlighted elevation benchmarks and how a half-foot swing changes outcomes near a boundary. I save their PDFs and sketches with my map packet, so anyone quoting me sees a coherent risk file.

Real estate and disclosures

Realtors reminded me to ask about past water issues, even if the map says Zone X. Sellers don’t always remember an old street-drain backup, but neighbors do. I walk the block, look for water lines on fences, and check slopes from driveway to gutter with a cheap level.

-

What I cover here:

-

Local government lessons

-

Insurer and survey takeaways

-

Street-level due diligence

-

*Samir Qureshi, PG (licensed professional geologist), adds: “Sandy soils drain fast—clay lenses don’t; bore logs matter more than labels when sites are marginal.”

🏠 My Home-Buy Checklist for Zone X

Before I make an offer

I run FEMA and county maps, then pull the parcel’s elevation if available. I sketch the lot slope and where water should go. I note panel IDs, effective dates, and nearest A/AE lines. If the distance is small, I price insurance as if I were inside A/AE—no regrets later.

On-site clues I trust

I visit after rain if I can. I check curb inlets, backyard swales, and the lawn’s high/low spots. I peek at garage thresholds and the first course of block. I want gutters emptying onto splash blocks, downspouts extended, and soil graded away from walls. These basics beat slogans.

Upgrades I actually plan

I budget early for gutters, French drains, backflow preventers, or re-grading small sections that push water away. I add smart sensors near doors and in low closets. An afternoon with a shovel and level prevented more headaches than any label ever did. Insurance is my backstop, not my first line.

-

What I cover here:

-

Map + parcel checks

-

Field checks that matter

-

Quick, high-return upgrades

-

*Courtney Lee, RA (licensed architect), counters: “Detailing at thresholds and slab edges is the cheapest flood protection most owners never verify.”

🔁 My Mistakes & What I’d Do Differently

The “one map is enough” mistake

I once trusted the FEMA view without peeking at county overlays. The county showed historic ponding along my street after multi-day storms. That second look changed my gutter plan and my deductible. Now I never stop at one source, especially in older neighborhoods with quirky drainage.

The “rainfall isn’t flooding” mistake

I used to think “flooding” meant only rivers and surge. Florida taught me that rainfall plus bad drainage equals floor repairs. I learned to read the land’s micro-slope and ask about pump stations. If the street is the bowl’s low point, I plan for ponding and buy coverage.

The fix I keep using

I built a simple repeatable checklist: maps, slopes, drains, quotes. It’s boring—and it works. When I follow it, my premiums make sense, my lender is happy, and my weekends stay dry. I treat Zone X like a yellow light: proceed, but keep both hands on the wheel.

-

What I cover here:

-

Why redundancy matters

-

Rainfall-driven risk

-

A reusable process

-

*Riley Thompson, CEM (Certified Emergency Manager, IAEM), adds: “Back-to-back storms stack risk—timing matters as much as totals.”

👥 My Case Study: Helping a Tampa Buyer in Zone X

I worked with a buyer in unshaded Zone X, one block from an A-zone line. FEMA showed minimal risk; county GIS showed a shallow swale and a history of street ponding after long storms. We tightened gutters, extended downspouts, and priced both NFIP and private coverage to compare.

We documented everything: panel ID, effective date, distance to the A-zone, and a quick measure of slab height compared to the street. The seller shared photos from a heavy-rain week—no interior water, some curb ponding. That honest context kept everyone calm and got us a fair premium.

Tampa Buyer — Fast Risk Snapshot

| Item | Detail |

|---|---|

| Zone type | X (unshaded) |

| Panel & effective date | 12057C0XXXF — 09/26/2014 |

| Distance to A-zone | ~420 feet (street centerline) |

| Elevation vs. street | ~+1.1 ft at slab |

| Quotes (building only) | NFIP: mid-$3xx; Private: low-$3xx |

*Lena Ortiz, RPLS (Registered Professional Land Surveyor), notes: “A quick spot shot to the crown of road tells you more about flow paths than any brochure.”

❓ My FAQs on Zone X in Florida

Is Zone X the same as “safe”?

No. Zone X is lower probability, not zero. I still walk the lot, check drains, and price a policy. Peace of mind matters more than the label, especially near older subdivisions or shallow swales.

Do I need flood insurance in Zone X?

Federal rules don’t require it, but lenders can. I often buy it anyway. A small premium beats a large repair bill, and Zone X pricing can be reasonable—especially if the home sits high and far from mapped water.

Why does a private risk site say higher risk than the FEMA label?

Different models use different inputs—rainfall, elevation, and past events. I compare multiple sources, then confirm on-site slopes and drains. When in doubt, I assume water will find the lowest spot and plan accordingly.

Can preliminary maps affect me?

They can signal what’s coming. Lenders usually rely on effective maps, but I still plan to the stricter picture if a boundary might move. It protects my budget and keeps surprises away.

What paperwork do I keep?

Screenshots or PDFs with the legend, panel number, and dates; any elevation notes; and quotes from at least two carriers. That mini-file speeds underwriting and future renewals.

*Derrick Chang, CPCU (Chartered Property Casualty Underwriter), adds: “Documentation closes pricing gaps—clean files get cleaner quotes.”

✅ My Takeaways: A Fast Decision Flow

I treat Zone X like a practical green light with guardrails. First, I find the label and the effective date. Second, I look at slopes, drains, and any history of ponding. Third, I price policies the same day. Finally, I plan simple upgrades that move water away from the house.

My rule is simple: if I can picture water pooling in a big storm, I don’t argue with the map—I prepare for it. A small annual premium, a couple of downspout extensions, and smart grading beat panic repairs. Zone X is the start of my homework, not the end.

-

What I cover here:

-

A repeatable flow

-

Fast pricing steps

-

The “improve, then insure” mindset

-

*Priya Desai, AIA (licensed architect), offers a counterpoint: “Design resilient first—insurance is the safety net, not the plan.”

Leave a Reply