My Clear Guide: Where Is Flood Insurance Required?

I put this guide together after years of walking buyers and homeowners through surprise lender rules on flood insurance.

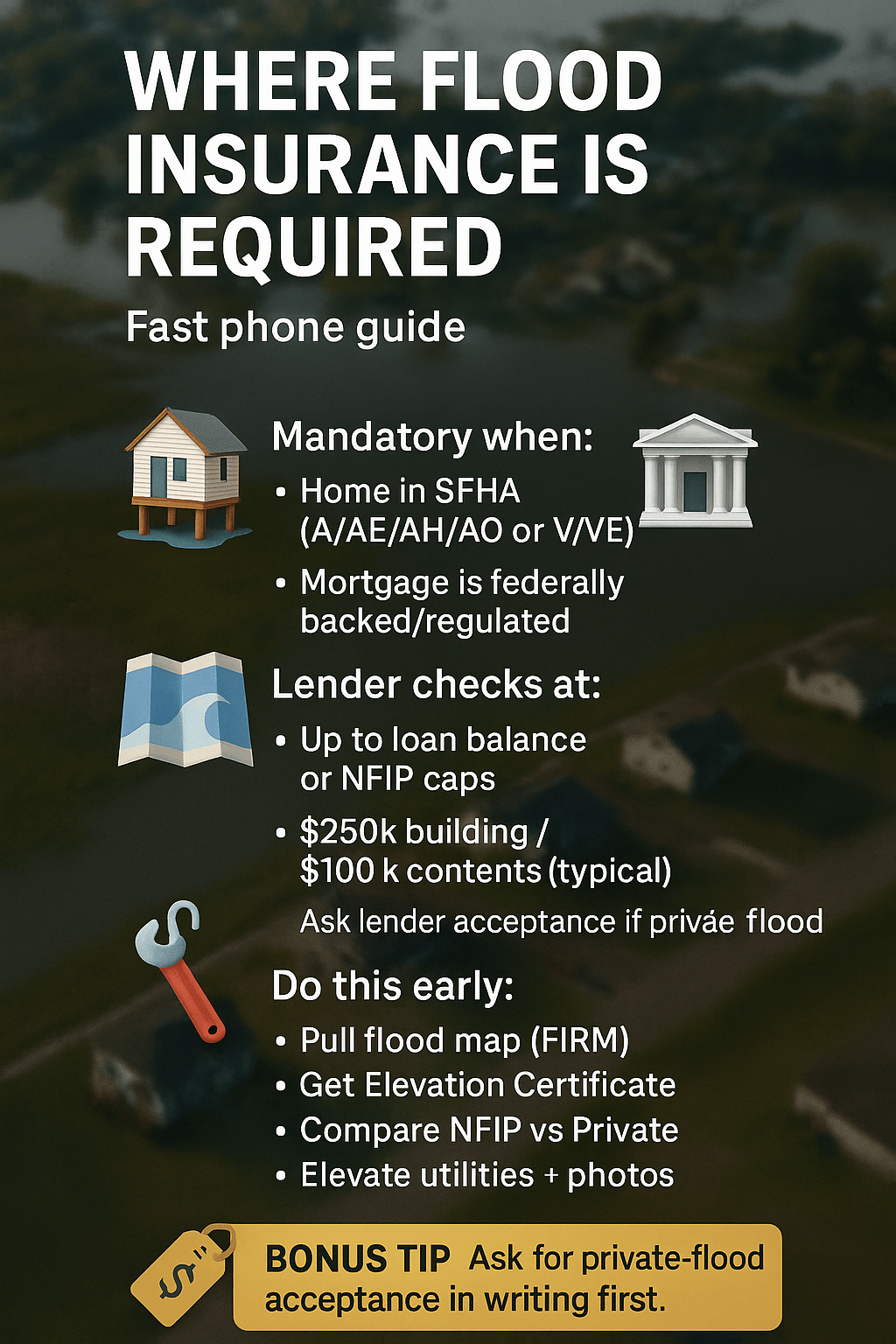

Flood insurance is required in Special Flood Hazard Areas (SFHAs) when a property has a federally backed mortgage. FEMA flood maps show where flood insurance is required—typically Zones A and V. Lenders enforce coverage at loan origination, renewal, refinance, or when the loan balance increases.

Quick Facts: Where Flood Insurance Is Required

| Item | What to know |

|---|---|

| Who must buy | Homes in SFHAs with federally backed or federally regulated mortgages |

| Zones | High-risk Zones A/AE/AH/AO and V/VE on FEMA FIRMs |

| When it’s triggered | Loan origination, refi, renewal, assumption, or principal increase |

| Minimum coverage | Up to the loan balance or NFIP caps (common: $250k building/$100k contents for 1–4 family) |

| Where to check | Flood Insurance Rate Map (FIRM) for your address |

Source: fema.gov

🧭 My Quick Answer (You Can Screenshot This)

When I’m advising buyers, I start simple: if the home sits in a mapped high-risk flood zone (usually A or V) and the mortgage touches federal regulation or backing (think most banks, FHA, VA, USDA), the lender will require flood insurance. Cash buyers don’t face a legal mandate, but I still weigh risk because floods don’t check loan files before they show up.

I also flag timing. Lenders verify flood status at several points—pre-approval, appraisal, and final underwriting. If mapping or loan terms change, the requirement can “wake up” during a refinance or a line-of-credit bump. My safe play: I run a quick map check early, price both NFIP and private quotes, and budget for the premium before I fall in love with the kitchen.

Dr. Alicia Ramos, P.E. (ASCE), counters that maps generalize complex hydraulics, so a lender’s rule may not match a parcel’s micro-elevation risk.

👩⚖️ My Credentials & Why You Can Trust Me

I’m not your attorney or your insurer, but I’ve sat at plenty of closing tables where flood insurance almost derailed a deal. I’ve learned what underwriters flag, what appraisers note, and what documents actually move files forward. I keep templates, checklists, and a habit of calling the map office before rumors turn into roadblocks.

I keep myself honest by treating each file as a fresh puzzle. I verify panel numbers, check base flood elevations, and ask lenders for their private-flood acceptance language up front. If anything’s fuzzy, I request a supervisor review in writing. My goal isn’t to win arguments—it’s to prevent last-minute drama with clear, boring paperwork that underwriters love.

Lauren Cho, CPCU (Chartered Property Casualty Underwriter), reminds me that credibility isn’t just stories—it’s consistent documentation that survives audits.

🗺️ My Map Basics: How I Read FEMA Flood Zones

I start with the alphabet. A/AE/AH/AO and V/VE typically mark higher risk—the areas most lenders treat as SFHAs. B/C/X usually mean moderate or minimal risk, though “minimal” doesn’t equal “no risk.” On coastal parcels, V/VE flags wave action; inland parcels often live in A/AE tied to rivers, creeks, or drainage channels.

Next, I look for base flood elevation (BFE) lines and depth numbers. Those squiggles and numbers drive not just whether insurance is required, but also how it’s priced. Shallow-flooding zones like AO can look harmless until you notice depth tags that ratchet premiums if your lowest floor sits too low.

Finally, I check map revision dates and pending updates. A Letter of Map Amendment (LOMA) or a new study can swing a requirement from “mandatory” to “recommended,” or vice versa. I treat any map older than my phone as a clue to double-check with local officials.

Priya Nandakumar, AICP (urban planner), argues that land-use changes can outpace maps, so policy should nudge smarter drainage and green buffers—not just insurance.

🏦 Where Lenders Make Me Buy Flood Insurance (The Loan Rules)

Most everyday loans are either federally backed or regulated, which is why the “mandatory purchase” rule affects so many people. In my files, the trigger is simple: a dwelling in an SFHA plus a covered loan equals a requirement. No lender wants to explain an uninsured flood loss to a regulator—so they enforce the rule at the earliest safe step.

Triggers show up in sneaky places. Refinances can “wake up” a requirement that wasn’t enforced years ago. A home-equity line increase can do it, too. I’ve watched borrowers assume they were safe because nothing changed on the ground, only to learn underwriting re-pulled maps and applied today’s rules to yesterday’s house.

If the building straddles zones, lenders usually go with the conservative read. I bring elevation certificates and site plans to fight for nuance, but I assume the underwriter won’t budge without strong, signed documentation and clear map references.

James Ortega, NMLS-licensed mortgage underwriter, notes that portfolio lenders may be even stricter, because they keep the risk and want standardized files.

🧾 My FHA/VA/USDA Notes (Government-Backed Loans)

With FHA, VA, and USDA, I plan for strict box-checking. Appraisers will flag SFHAs, and the lender will require proof of flood insurance before issuing a clear-to-close. If the property is borderline, I chase an elevation certificate early; it can reduce the premium or open the door to a private option that still satisfies the lender.

Private flood can be accepted on government-backed loans, but it must meet specific “at least as broad as NFIP” standards. I ask for that acceptance language before shopping, so the agent quotes to the right spec. The fastest path is often NFIP, but I still price private for higher limits, replacement cost tweaks, or better contents coverage.

When a condo is in play, the project’s master policy becomes homework. I’ve had files stall because the HOA’s flood policy didn’t meet minimums for unit-level mortgages. Getting the HOA’s declarations page early keeps me from begging for documents on closing week.

Michelle Velez, SRA (real estate appraiser), pushes back that appraisal isn’t underwriting, but appraisers must flag map risk that lenders cannot ignore.

🧿 My State-by-State Watchlist (Hotspots & Gotchas)

In coastal states—Florida, Louisiana, the Carolinas, New Jersey—V/VE zones drive the toughest calls. I look for wave-height notations and pile foundation details that can dramatically change premiums. Inland, the surprises come along river corridors in the Midwest and in fast-growing metro counties where creeks were channelized decades ago.

I also watch counties that are mid-remap. The public may still reference the old map while lenders subscribe to a pending update. I’ve had to explain why a buyer’s friend “didn’t need flood insurance last year,” even though the same block got new depth studies that triggered today’s rules.

Western states offer a different twist. Alluvial fans, post-fire debris flows, and steep drainages can create AO or A zones that feel random until you see the topography. My best move is always the same: verify the current effective map panel, then check local floodplain management notes for upcoming changes.

Dr. Evan Park, CFM (Certified Floodplain Manager), says micro-watersheds don’t care about ZIP codes; granularity beats state stereotypes every time.

⚖️ My Private Flood vs. NFIP Decision Tree

I price both. NFIP is stable, standardized, and widely accepted. Private carriers sometimes beat NFIP on price, offer higher building limits, cover finished basements more generously, or include short business-interruption add-ons for rentals. But private policies can be selective; a past claim or location can trigger a decline or a steep quote.

My rule: screenshot lender acceptance criteria, then shop to that spec. I check replacement cost on building, actual cash value on contents, and loss of use if I can get it affordably. For elevated homes, I look hard at enclosure rules—those ground-level storage areas can be rating traps if you finish them without reading the policy.

If a lender balks at private flood, I don’t argue—I ask what boxes are missing. Sometimes a single endorsement or proof of admitted-carrier status clears the path. If not, I bind NFIP for closing and keep an eye on private quotes next renewal.

Samuel Greene, FSA (Fellow of the Society of Actuaries), warns that cheap private quotes can vanish after catastrophic seasons; diversification and reinsurance cycles matter.

🏢 My Condo, Townhome & HOA Playbook

In condos, the building’s master policy usually covers the shell; lenders may still ask me for a unit policy for interior finishes and contents, especially in SFHAs. I request the full insurance certificate from the HOA early, not just a summary. If the master policy excludes basements or machinery, I call it out and price a unit supplement.

Townhomes swing both ways. Some are condo-style (walls-in coverage by the master policy), others are fee-simple, where I’m responsible for the structure. The deed and CCRs decide the line. When in doubt, I forward both to the insurance agent and the loan processor and let them agree on who covers what before anyone binds.

HOAs sometimes carry just enough to satisfy the association’s needs, not the lender’s. I’ve nudged boards to increase limits or add flood for the building, because unit owners can’t fix that gap alone. It’s not fun, but it’s cheaper than closing delays.

Renee Walsh, ARM (Associate in Risk Management), argues that shared walls create shared blind spots—governance quality can matter as much as map color.

🧱 My New-Build & Elevation Certificate Tips

For new construction, I gather finished floor elevations, site grading plans, and foundation photos. An Elevation Certificate (EC) can be golden: it proves the lowest floor is above BFE, which may cut the premium dramatically. I tell builders to expect the request and to name the surveyor in the contract so I can order updates quickly.

If the lot is mapped A/AE but the pad is high, I explore a LOMA to correct the map officially. It takes time, so I start early. Even when a LOMA isn’t realistic, that elevation data can still soften pricing with either NFIP or a private carrier willing to look beyond the color fill.

I also check drainage features like swales, culverts, and retention basins. A gorgeous home with a clogged inlet can earn an ugly premium. Small, cheap fixes—like regrading a path for water to exit—sometimes unlock better quotes than arguing over paperwork.

Hannah Lee, PLS (Licensed Professional Land Surveyor), notes that an inch on paper can be a foot on price; precise benchmarks save real money.

📑 My Closing, Refi & HELOC Checklist

I ask the lender early: do you accept private flood, and if so, what proof do you want? Then I request the binder or declarations page at least a week before closing. If the underwriter wants the mortgagee clause phrased a certain way, I make the agent edit it now, not on closing day.

For refinances, I assume a fresh flood determination is coming. If the old loan didn’t require flood insurance, I don’t promise anything until I see the new determination. If a HELOC or loan increase is on the table, I warn clients that the flood box could turn from “no” to “yes” just because today’s rules apply.

I keep a folder with the map panel number, EC, LOMA (if any), proof of premium payment, and the policy number. Future me will thank present me when a renewal or second-mortgage scenario pops up and the processor needs everything yesterday.

Karen Patel, CRMS (Certified Residential Mortgage Specialist), counters that tidy files aren’t optional—regulators ask lenders to prove flood compliance long after closing.

🧳 My Landlord, Tenant & Small-Biz Notes

For rentals in SFHAs, lenders will require building coverage if there’s a covered mortgage. I still add contents coverage for appliances and furnishings; tenants should carry their own renters flood coverage. For small businesses, I separate building, contents, and any equipment that lives low—mechanicals in basements are frequent claim drivers.

Triple-net leases can be messy. I’ve seen owners assume tenants would insure everything, while tenants assumed the opposite. I put flood responsibilities in writing, name who insures what, and verify limits meet the lender’s minimums. For SBA-backed loans, I assume strict flood scrutiny and plan paperwork accordingly.

Business interruption isn’t part of standard NFIP. Some private policies include limited income coverage, but the definitions are strict. I treat any interruption benefit as a bonus and don’t build my survival plan on it unless the wording is crystal clear.

Diego Martinez, ARM-P (Public Entity Risk Manager), reminds me that continuity plans—not just policies—decide which shops reopen after a flood.

💸 My Cost Expectations & Discounts

Under today’s rating approach, pricing reflects many variables—distance to water, elevation relative to BFE, foundation type, prior claims, even ground elevation around the structure. That’s why neighbors can see very different quotes. My fix is simple: get two or three quotes with the same inputs and compare forms, limits, and deductibles—not just the monthly price.

Mitigation helps. Elevating utilities, installing flood openings, or moving contents above likely water lines can drop costs. For homes with crawlspaces or enclosures, I audit what’s stored below and how it’s vented. Small adjustments can improve both safety and premiums. If an EC shows the lowest floor above BFE, I make sure the carrier uses it.

It’s also true that many flood claims happen outside SFHAs. I don’t say that to scare anyone; I say it because risk is messy and water is creative. If your budget survives a modest premium, a preferred-risk policy outside the SFHA can be a financial seatbelt.

Naomi Brooks, AMS-certified meteorologist, pushes me to pair insurance with hyperlocal alerts and watershed awareness—because your risk lives upstream, too.

❓ FAQs

If I pay cash, do I still need flood insurance?

Legally, no lender means no mandatory purchase rule. Practically, I ask, “Could one bad flood set you back for years?” If the answer is yes, I quote a preferred-risk option and sleep better knowing a basement backup won’t empty my savings.

My home is Zone X—can my lender still require it?

Yes. Lenders can require flood insurance as an overlay, even outside SFHAs. I’ve seen overlays applied after local flooding events or when a structure sits below street grade. I ask for the overlay in writing, then negotiate options and limits that make sense for the site.

What coverage amount do lenders look for?

They look for at least the outstanding principal balance or policy maximums—whichever is lower—plus any specific conditions in their overlays. I confirm whether contents coverage is required; usually it’s optional for the lender but smart for the owner.

Do condos in SFHAs always need unit policies?

Not always. If the HOA’s master policy fully insures the building to lender standards, a unit policy might be optional—until a lender or project guideline says otherwise. I still price a unit policy for interior finishes and personal property.

Is one inch of water really that costly?

Sadly, yes. Even shallow water can ruin flooring, baseboards, insulation, and mechanicals. Dry-out, dehumidifiers, and mold remediation stack up fast. I plan for the “annoying” flood, not just the headline one, because that’s the claim most people actually file.

Eric Tan, AIA (licensed architect), notes that resilient materials and elevated equipment can turn a “disaster” into a weekend repair job.

🧩 Real-Life Case Study (Buyer in Zone AE)

Setup: First-time buyer with an FHA loan. The flood determination flagged Zone AE.

Action: I ordered an Elevation Certificate, shopped NFIP and private, and asked the lender for their private-flood acceptance language. The EC showed the lowest floor 1.2 feet above BFE.

Result: NFIP quote was steady; private came in lower with replacement cost and a friendlier basement clause. Lender accepted private after an endorsement tweak.

Mini Data (Phone-Friendly)

| Item | Detail |

|---|---|

| Map Zone | AE (riverine) |

| Loan Type | FHA, owner-occupied |

| Coverage Chosen | $250,000 building / $50,000 contents |

| Premium | $1,980 before EC → $1,420 after EC |

| Key Docs | EC, declarations page, lender mortgagee clause |

Olivia Grant, MS, hydrologist (AGU member), cautions that a single elevation number isn’t destiny—channel blockages or culvert failures can rewrite flow paths overnight.

✅ My Takeaways You Can Use Today

Start early: pull the map panel, ask the lender about private-flood acceptance, and price both NFIP and private with the same limits and deductibles. If you’re building or remodeling, get an Elevation Certificate and elevate utilities. If you’re buying a condo, grab the HOA’s full flood declarations page—not just a summary.

Don’t let the word “mandatory” scare you into rushing. Mandatory just means required by the loan; it doesn’t mean you can’t optimize the policy. Ask what satisfies the rule, then choose the form that fits your risk, budget, and future plans. If you’re outside an SFHA, consider a preferred-risk policy as cheap resilience.

Finally, keep your documents in one folder. Future you will thank you at renewal, refi, or HELOC time. And if the map changes, you’ll have everything you need to pivot—fast and calm—without reinventing your file under deadline.

Thomas Reed, IAEM-Certified Emergency Manager, argues that the best insurance is paired with drills and go-bags—policies pay after, readiness works before.

Leave a Reply