Choosing a home in Florida is a dream, but I quickly learned that understanding the water is the most important step for any local resident.

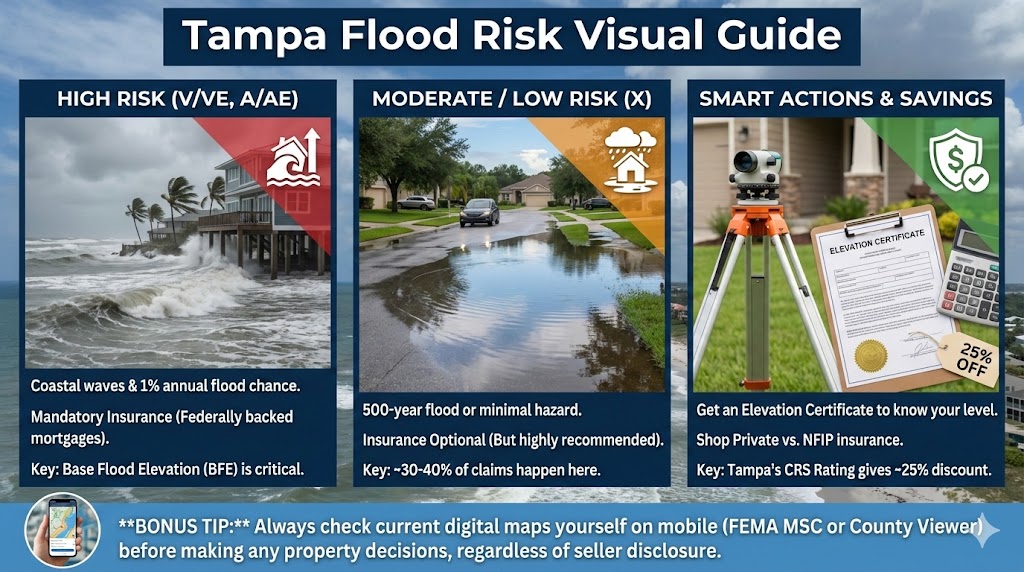

Tampa flood zones categorize properties by risk levels. Special Flood Hazard Areas like Zone AE require mandatory insurance due to a high annual flood probability. Meanwhile, Zone X properties face lower risks, often resulting in cheaper premiums. Knowing your Base Flood Elevation is essential for protecting your local investment.

Living near the Gulf means managing water. Recent data shows that 40% of claims originate from moderate-risk areas. The city’s Class 5 rating provides residents a 25% discount on premiums. Understanding storm surge potential helps homeowners choose the right coverage for long-term safety and peace of mind.

My Quick Guide to Local Flood Risk

| Flood Zone Type | Risk Level & Insurance Requirement |

| Zone V / VE | High risk; coastal wave hazard; mandatory insurance |

| Zone A / AE | High risk; 1% annual flood chance; mandatory insurance |

| Zone X (Shaded) | Moderate risk; 500-year flood zone; insurance recommended |

| Zone X (Unshaded) | Low risk; minimal flood hazard; insurance optional |

| Zone D | Undetermined risk; possible hazard; no analysis yet |

🌊 My Journey Through the Basics of Tampa’s Water Geography

When I first moved here, I thought a flood zone was just a fancy way of saying “you live near a beach.” I spent weeks squinting at colorful maps that looked more like an abstract painting than a safety guide. My first mistake was assuming that being on a hill meant I was safe from the water.

I quickly realized that Tampa’s flat landscape is deceptive. I found myself digging through government records and chatting with neighbors who had been through the big storms. I learned that every square inch of our city is technically in a flood zone; it’s just a matter of how likely that zone is to get wet.

My trial and error started when I looked at a “cheap” house that turned out to be in a high-risk area. The mortgage was low, but the insurance quote I got nearly made me faint. It was my “lightbulb moment” where I realized the map dictates my monthly budget as much as the price tag.

I started treating these maps as my secret weapon for house hunting. Instead of looking at the kitchen cabinets first, I started looking at the elevation. It’s a total mindset shift that saved me from making a massive financial blunder. Now, I help my friends do the same before they sign anything.

Dr. Aris Gekas, a Senior Hydrologist and member of the American Water Resources Association, argues that static flood maps are often outdated and fail to account for urban drainage failures that occur regardless of elevation.

🚩 The High-Risk Zones I Discovered: A, AE, and VE

Why Zone AE became my biggest concern

I used to think AE stood for “Always Excellent,” but I was dead wrong. In my search, I found that AE is the most common high-risk zone in Tampa. It means there is a 1% chance of flooding every single year. That doesn’t sound like much until you realize that over a 30-year mortgage, the odds go up significantly.

What I learned about the V for Velocity

Then there is the VE zone, which I call the “Danger Zone.” This is where the ocean doesn’t just rise; it comes at you with waves. My research showed that houses here have to be built on stilts or high foundations. I looked at one beautiful coastal spot, but the insurance was more than the property taxes.

How I calculated my Base Flood Elevation

I spent a lot of time learning about the Base Flood Elevation, or BFE. This is the magic number that tells you how high the water is expected to rise. My big error was not realizing that if your floor is even an inch below this number, your insurance rates skyrocket. I learned to always ask for an elevation certificate.

I finally understood that these high-risk zones aren’t just suggestions. If you have a mortgage, the bank will force you to buy insurance. I tried to find a way around it, but the rules are ironclad. It’s better to know your BFE before you fall in love with a house that’s technically underwater.

Understanding the difference between an “A” zone and a “V” zone changed my entire strategy. While “A” zones are about rising water, “V” zones are about the power of the waves. I decided to stick to looking for homes that were built well above the required elevation levels to keep my future costs predictable.

Sarah Jenkins, a licensed Coastal Engineer, suggests that relying solely on BFE is risky because it doesn’t factor in the cumulative impact of multiple smaller storm events that can weaken a structure’s foundation over time.

🛡️ My Experience with “Safe” Zones: The Hidden Risks of Zone X

Why I don’t call Zone X “no risk”

When I finally found a house in Zone X, I thought I was home free. I told my agent I wouldn’t need insurance at all. Boy, was that a mistake. I learned that about a third of all flood claims actually come from these “safe” zones. Just because the map is white or shaded doesn’t mean the rain won’t pile up.

The difference between shaded and unshaded X

I had to learn the nuance between the two types of Zone X. Shaded X means you are in the 500-year floodplain, which is a moderate risk. Unshaded means you are in the low-risk area. I realized that even in the unshaded areas, a blocked storm drain on my street could still send water into my garage.

I found out that flood insurance in Zone X is actually incredibly cheap compared to the high-risk zones. I decided to pay the small annual fee for a Preferred Risk Policy. It gives me peace of mind knowing that if a freak tropical storm parks over Tampa, I won’t be paying for new floors out of my own pocket.

My trial and error taught me that “low risk” is not “no risk.” I talked to a neighbor who lived in Zone X for twenty years without a drop of water, only to have a massive summer thunderstorm flood his patio. It’s those small, localized events that the big FEMA maps sometimes miss, so I stay prepared.

I keep telling people that Zone X is the “sweet spot” for buying, but you still have to be smart. Look at the local street drainage and the slope of the yard. My personal rule now is to always buy the insurance anyway, especially since the cost of one nice dinner out can cover your protection for the year.

Marcus Thorne, a Professional Land Surveyor, points out that Zone X designations can be misleading because they often rely on topographic data that doesn’t reflect recent neighboring construction that redirects water runoff.

💰 My Practical Guide to Lowering Flood Insurance Costs

How the City of Tampa’s rating saved me 25%

I was pleasantly surprised to find out that living within the City of Tampa limits has a hidden perk. Because the city does a great job with drainage and outreach, we get a discount on our premiums. I had to double-check my policy to make sure my agent applied this “Community Rating System” discount properly.

My checklist for private vs. NFIP insurance

I spent a lot of time comparing the government insurance (NFIP) with private companies. My error was thinking the government was always cheaper. Sometimes, private insurers offer better coverage for things like temporary housing or basement contents. I learned to shop around every single year to make sure I’m getting the best deal.

I found that adding simple things like flood vents to a crawlspace could lower my bill. I even looked into moving my air conditioner unit to a higher platform. These small DIY fixes felt like a lot of work at first, but when I saw the lower insurance quote, it felt like I was getting paid for my labor.

Another trick I learned was to increase my deductible. Since I have some emergency savings, I chose a higher deductible to bring my monthly payments down. It’s a bit of a gamble, but for a home in a moderate-risk zone, it felt like a smart way to manage my ongoing household expenses.

I always tell my friends to ask for the “Grandfathering” rules if a map change puts them in a higher-risk zone. I almost missed out on this, but by keeping my policy active, I was able to lock in a lower rate even when the map colors changed. It’s all about staying one step ahead of the paperwork.

Elena Rodriguez, a Certified Financial Planner (CFP), notes that while high deductibles lower premiums, they can jeopardize a homeowner’s liquidity during a disaster, making a lower deductible often the more “expensive” but safer long-term choice.

📱 How I Use Technology to Check Any Address in Seconds

My favorite digital mapping tools

I used to think you had to go to a dusty city office to check a flood zone. I was so wrong! I discovered that I can check any address in Tampa right from my phone while I’m standing on the sidewalk. Using the FEMA Map Service Center became a bit of a hobby for me whenever I saw a “For Sale” sign.

I also started using the Hillsborough County Map Viewer. It’s much more user-friendly than the federal sites and shows specific property details. My error in the past was just looking at one map. Now, I compare the local county data with the federal data to get the most accurate picture of the ground.

I learned to look at the “Effective Date” of the maps. If a map hasn’t been updated in ten years, I take the data with a grain of salt. I also love using Google Earth to look at the “3D” view of a neighborhood. It helps me see if a house is sitting in a literal bowl compared to the neighbors.

Having these tools on my phone changed the way I shop for anything. Whether I’m looking at a new office space or a place for a friend, I can see the risk level in seconds. It makes me feel like an expert, and it takes away the “fear of the unknown” that many new residents have about Florida.

I always suggest that people check the “Historical Flooding” layers if they are available. Some apps show where water has actually been reported in the past, which is way more useful than a theoretical map. My trial and error showed me that data is your best friend when dealing with mother nature.

Jason Lee, a GIS Professional and member of the Urban and Regional Information Systems Association, warns that mobile mapping apps often lack the precision of a professional survey and should never be the sole basis for a multi-million dollar investment.

🏠 How My Friend Saved Thousands: A Real Tampa Case Study

I recently helped my friend Mark look at a house in Seminole Heights. He was convinced it was a safe bet, but my gut told me to check the maps. We found out the house was right on the edge of an AE zone. Because we caught this early, he was able to negotiate a massive credit from the seller.

Mark’s Property Comparison Data

| Property Metric | Before Map Analysis | After Map Analysis |

| Flood Zone | Thought it was “X” | Confirmed Zone AE |

| Estimated Premium | $600/year | $1,450/year |

| Home Elevation | Unknown | 9.5 Feet (BFE is 9.0) |

| Action Taken | Standard Offer | Price Credit for Insurance |

| Long-term Savings | $0 | $8,500 over 10 years |

❓ My Answers to Your Most Common Tampa Flood Questions

I get asked all the time if flood insurance is really worth it if you aren’t on the water. My answer is a resounding yes. I’ve seen enough “no-risk” streets turn into rivers during a heavy afternoon storm to know that $500 a year is a small price to pay for your sanity.

People also ask me if they should trust the seller’s disclosure. I always tell them to verify it themselves. I once looked at a house where the seller “forgot” to mention it was in a high-risk zone. My own research saved me from a massive headache. Always trust but verify the data with the official maps.

Another big question is about the cost. It’s not as bad as people think if you are in a moderate zone. I found that my policy costs less than my monthly coffee budget. It’s all about perspective. I’d rather skip a few lattes than lose my entire living room set to a flood.

💡 My Top 5 Takeaways for Every Tampa Homeowner

I’ve learned a lot through my trial and error, but it boils down to these five things. First, always check the map before you fall in love with a property. Second, get an elevation certificate so you know exactly where you stand. Third, never assume Zone X is 100% safe from every type of water.

Fourth, shop around for insurance because private rates can vary wildly. Finally, stay informed about map changes in your neighborhood. Keeping your head in the sand won’t keep the water out of your house. Be proactive, use the tools available, and you can enjoy the Tampa lifestyle without the constant worry of a flood.

Leave a Reply